This stems from what I learned in two very different classes at Harvard, one on New Town Development in China – offered by the urban planning department at the Graduate School of Design, the other on Political Institutions and Economic Policies – offered by the government department at the Faculty of Arts and Sciences. The first class took me on a field trip sponsored by Vanke Group, China’s largest residential real estate developer. During the trip, I began to investigate why Chinese cities usually look so much older than they actually are, and the political science class lent me the intellectual tools to diagnose the misaligned incentives that lead to the poor maintenance of Chinese communities. This was my first attempt to write about the interaction between parties of different interests, which later became a lens I frequently use to analyze the urban world. The study reflects situations observed in 2015.

_______________________________________

I. Introduction

It is not uncommon to see private real estate developers providing goods and services that improve the public realm, especially in gated urban communities. Theoretically speaking, even though collectively appropriated goods and services are subject to market failures, real estate development can overcome this problem because the value of public services is ultimately captured in land and property prices. In Public Goods and Private Communities, the economist Fred Foldvary wrote:

“Territorial goods are capitalized within their area of impact. To the extent that (1) the goods are valued positively by the residents and enterprises in the area, and (2) the benefits can only be obtained by being located in the area, they make the location more desirable, and this marginal increase in the demand to be located in that territory increases the ground rent that persons are willing to pay.”

However, private communities in China do not demonstrate the efficiency predicted by such a school of thought; instead, urban services in Chinese residential neighborhoods are severely undersupplied, demonstrated by low-quality physical maintenance and insufficient capital repairs of common areas. Building facades are not frequently cleaned, and pavements and landscaping are often neglected. This is because, although private communities might overcome market failures, there are still institutional failures that can structurally undermine the mobilization of people and resources for the common good. The lens of political economy shall help illustrate the details of these failing arrangements and their consequences.

II. Who Is Involved In Urban Service Planning?

To understand why service provision is failing in these communities, I sampled residential developments built by Vanke Group. During the research fieldwork, I visited five Vanke properties in three cities (Wuhan, Zhengzhou, and Chengdu) and interviewed Vanke’s local business directors and property managers. My observations and conversations with them serve as the empirical basis of this investigation.

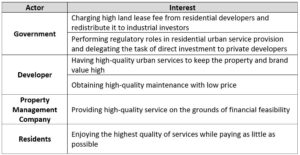

Before I proceed to analyze the institutional failures of urban service provision, it is necessary for those unfamiliar with Chinese urbanization to know some background of the key players and understand their motivations and behaviors. There are four main actors in the game – local governments, developers, property management companies, and residents. Their interests and actions shape the supply and demand of urban services, and how they interact with each other determine the outlook of service provision in privately built urban communities.

China’s local government spends little on residential community’s services and maintenance. This is a result of China’s current tax system. Unlike the US municipalities, where residents pay property tax to “buy” government services, Chinese governments cannot finance urban services by charging residents’ estates. Instead, China’s municipal revenue mainly comes from two other sources: a large upfront lump-sum gain when the government transfers the land development right to real estate developers, and a steady subsequent income stream from value-added tax. The upfront land lease fee is quite a powerful financing tool for cities’ initial capital investment in city hardware. Taxation should theoretically support the city’s long-term operation and service provision, but because 75% of the local tax collected goes to the central government per China’s 1994 Tax Sharing Reform, this income does not really help Chinese municipalities to afford all the services in need. In other words, due to China’s unique institutional environment, local governments are “rich” when doing upfront capital investment such as expanding the urban areas but “poor” in the subsequent maintenance.

The role of Chinese developers is both governmental and entrepreneurial. When the government fails in service provision, developers perform a lot of municipal tasks in effect, building a lot of the hardware infrastructure such as roads, landscaping, plumbing, and even schools. They are not required to maintain these amenities, however, because maintenance is usually in the hands of the property management firm. For the developer, the maintenance of community assets is a kind of after-sale service that the developer is not directly responsible for. Because developers are mostly interested in selling properties, they actually have an interest in lowering the property management fees to make the price more appealing to prospective homebuyers.

The situation of property management in China is complicated, especially in communities developed and managed by Vanke. Before 2007, Vanke’s property management team was an internal department in Vanke Development. Being in the same firm with the development team means that property management could pursue the highest quality without worrying too much about the cost; after all, maintenance costs were subsidized by development. However, in 2007, Vanke Group separated property management from Vanke Development, and Vanke Property Management hence became a financially independent subsidiary of Vanke Group. As it no longer receives subsidies from Vanke Development, Vanke Property Management now must maximize its own profit. The financially independent property management team has to increase its revenue and reduce its production cost. However, raising fees has met strong resistance from the customers.

After the sale of housing units, the property ownership is passed from the developer to the residents. Legally speaking, it is the residents that hire the property management company to maintain the property; if the residents are not satisfied with the property management team, they can fire it. In dealing with management companies, residents have strong motivations to ensure that the service quality is maximized and the price is minimized. They do not, however, have the necessary means to organize themselves collectively due to the weak social ties in most contemporary Chinese neighborhoods.

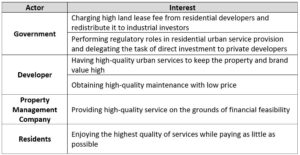

III. Institutional Failures of Multi-Party Interactions

When these four parties interact, institutional failures arise that make private provision of public goods go wrong in China’s residential communities. I focus mainly on the maintenance aspect of urban services, such as cleaning the apartment facades, pruning the street trees, and rebuilding the playground. These services are taken care of by property management companies. Therefore, I will discuss property management companies’ interactions with the other three players – governments, developers, and residents. Each of these pairs of relationships faces its unique challenges.

Property management companies in China can finance their capital and expense expenditures with two streams of income. The first is the management fee paid by homeowners on a monthly basis. The second is a fund reserve for major capital reconstructions, paid by homeowners upfront. However, the amount of monthly fees is heavily regulated by the government, and the procedure to access the fund reserve is not easy.

In Wuhan, the government used to set up a series of pricing guidelines regarding the monthly fee. The pricing guidelines were effective from 2004 to 2013, and although they do not exist anymore nowadays, it is useful to understand their impact in the past. Vanke Property Management has every reason to want higher fees. However, in Wuhan, the government set the pricing cap at RMB 1.44 per square meter, applicable to all non-luxury residential real estate properties. According to interviews, this is a very low cap that leaves Vanke Property Management zero profit, resulting also in the very low level of service quality. Why did the government set the price so low?

Pricing cap is not the only way in which government intervenes in the business of privately supplied urban services. The government also sets a gridlock for the capital fund reserve. In China’s gated communities, when homebuyers purchase apartments from the developers, the buyers pay an extra amount of money to set up the Maintenance Funds Reserved for Housing’s Public Part and Common Facilities. If the funding is used up in the future, the residents will pay again for the refill. Governments take control of these funds. In Wuhan for example, the municipal government will be the fund manager unless 1) a homeowner’s association has been set up in the community and 2) that homeowner’s association has met seven specific conditions and filed proper applications to transfer the right of managing the funds from the government to the property management company on behalf of the association. The conditions and procedures prolong the application, thus ultimately making it difficult for the property management company to access capital money prepaid by the residents. Not surprisingly then, in Wuhan, a lot of community’s maintenance funds are still managed by the government, and Wuhan’s usage rate of these prepaid maintenance funds is very low. From 2000 to 2012, there has been a total of RMB 6,512,000,000 in the maintenance funds citywide, only 1.19% of which has been used successfully by property management companies to finance major repairs. Why did the government require such a fund but make the access difficult?

What the government did essentially is preventing the property management company from obtaining the residents’ money, first with the price cap, then by raising the company’s transaction cost to access the fund reserve. The government in effect protects the residents’ monetary interests, so that the residents pay low fees and do not need to frequently refill the fund reserve in the future. Why does the government protect the consumers’ interest rather than the producers’ interest? Aren’t the companies supposed to be more organized and thus more politically influential?

If one understands the deeper and more nuanced concerns of the Chinese government, these “abnormal” pro-consumer policies are reasonable. First, Chinese governments are not elected democratically, so lobbying works in a different way. Campaign money from companies and industries is not really necessary. Instead, Chinese governments have a stronger interest to please consumers, because of the Communist Party’s fear of any populist, angry, and organized movement that may weaken the already delicate social stability (there have been incidents when homeowner’s associations in Beijing protested publicly, which was identified as a social and political threat). Second, even if the government favored some producer interest in the real estate sector, it would protect the developer’s interest rather than the property management company’s interest. As has been mentioned earlier, both the developer and the property management company want a higher quality of service, but their attitudes towards pricing differ significantly. For property management companies, because they are responsible for input and output and because the demand for after-sale service is price inelastic, the price needs to go up. For developers, however, because pre-sale realty market has higher price elasticity and because the developer does not directly handle any after-sale services, the company would want to lower the after-sale service price to attract prospective buyers. When the developer wants lower service price and the property management company wants higher, the government listens to the developer, because the developer pays the land premium to the government. The property management company, though raising the value of urban properties, does not make direct contributions to the government.

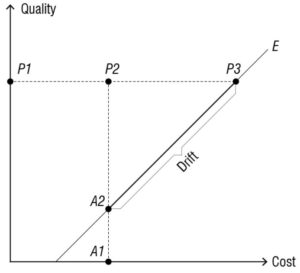

Besides government policies, property management’s relationship with the developer also constitutes an obstacle for service optimization. Vanke Group, as the owner of both the largest real estate developer and the biggest property management company in China, illustrates such problem aptly. As I mentioned earlier, before 2007, Vanke’s property management team and the developer team existed in the same company, allowing development to subsidize maintenance. Back then, Vanke Property Management was able to finance its extraordinary projects with a subsidy called “Care Package for Homeowners” provided by Vanke Development. In a way, the developer’s “Care Package” mitigated the negative effect of governmental interference.

However, in 2007, the headquarter of Vanke decided to make Vanke Development and Vanke Property Management two separate subsidiaries. Hence the two entities become financially independent of each other. All of a sudden, the internal subsidy was canceled, and Vanke Property Management could not finance major projects as easily as it used to. In the Vanke Garden City community that I visited in Wuhan, the director of Vanke Property Management in Wuhan told me: “the playground facilities have never been updated since 2007, after the cut-off of the ‘Care Package’ from the developer side.”

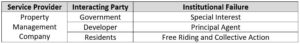

The relationship between Vanke Development and Vanke Property Management after the split-up is a classic principal and agent relationship. By making the management team an external entity, the developer created an agent for itself. First of all, we need to understand that there are many benefits for the principal to delegate certain tasks to an external agent. These benefits include:

However, by delegating the task of maintenance service to a separate agent, Vanke Development is also subject to problems due to the institutional imperfections. Vanke Property Management after independence is not a mere customer service department for Vanke Development anymore; it is also a firm that has to worry about its own profitability. It pursues interests that can run counter to the principal’s desire. Hence we have observed:

Therefore, for a principal who wants to ensure the high quality of service provision, the decision to make the property management department a financially independent firm has unfortunately backfired. The act of delegation creates a principal-agent problem and associated perverse incentives, and such institutional failures yield an unfortunate drift of outcome. The quality of service becomes lower than what the developer would like to see, because the property management company, having lost all of its intra-firm subsidies, has to worry about cost reduction and cuts down its production level.

The last set of relationship that affects the quality of urban service provision in China is the interaction between residents and the property management company. Even if the problems of governmental intervention and corporate structures were all perfectly solved one day, the service would still be undersupplied, due to the problems of collective action and free riding.

A manager of Vanke Club in the Wuhan office claimed: “Vanke is trying to transform itself from a mere homebuilder to an urban service provider.” He talked about Vanke’s goal in stepping into a more comprehensive area of urban services, such as schools and hospitals, in the era when China’s residential real estate market is gradually reaching a point of saturation. In other words, Vanke would want to become a firm that emphasizes its social agenda and become a leader in providing public services in Chinese cities. However, the manager then expressed the impossibility of such ambition, conceding that “a profit-driven firm does not provide public goods.”

Indeed, to include broad services as part of a firm’s viable business plan is itself very tricky for entrepreneurs, because Vanke has not yet designed a business model that reconciles the social agenda of servicing the community and the profit agenda of making money. Many residents refuse to pay for services. As expressed by a manager of Vanke’s property management in Chengdu, “Chinese residents still have this welfare mentality possibly as a result of the Communist era; they think that the various community services should be free to all, and property management companies, in order to be transparent, should not make any profit. Therefore, our attempt to raise the price has met very strong opposition from the residents.” This cultural and psychological resistance from the demand side shall explain partially why, even after the elimination of the governmental cap on pricing, the monthly fee is still kept at the firm’s marginal production cost.

Furthermore, besides this cultural explanation, the suboptimality of private provision of social services in new towns can also be examined in economic reasoning. Urban services are public goods. Public goods, by definition, are jointly consumed by more than one customers. However, due to this very collective nature, it is very difficult to reveal the individual demand for those services, because rational individuals might as well hide his true interest, thus refusing to pay while hoping to enjoy the overall benefits as long as others all pay. This is a classic free-riding problem. Due to such a tendency to freeride and without effective communal monitoring, each person can hide his true demand for jointly consumed public goods. Without accurate demand revelation, proper pricing is impossible, preventing the supplier from the optimal provision.

IV. Conclusion

For the property management company to improve the quality of urban services, it needs to have the financial means to increase the production input. However, in China, several institutional failures have impaired the company’s attempt to do so. First, the municipality intervenes with price caps and funding gridlocks, because China’s government favors the interests of residents and developers, who want low service prices. Second, in Vanke, due to the corporation’s decision to make Vanke Property Management a financially independent firm, the property management company suddenly becomes an agent with its own cost-saving agendas, thus not devoted fully to the goal of its principal, who is also quality-sensitive and wants to offer the best services in its ideal communities. Last, because China’s urban communities are large groups, the difficulty to organize the residents and the possibility of their free riding become the ultimate barrier for the property management company to charge higher prices and improve service quality. In conclusion, the suboptimal output of urban services in China’s residential communities contradicts and complicates the academic prediction that private provision of public goods can be effective. Because urban service provision in China involves multiple transacting parties (government, developers, property management companies, and residents), their power dynamics and interactions produce several institutional failures that have impaired the supposedly efficient private supply of public goods.

_______________________________________

Extra Thoughts: What Can Be Done?

Luckily, for Vanke Property Management, it is viable to propose and implement new institutional arrangements with residents, even though government policies and corporate structures are not easily amended. Currently, Vanke Property Management has experimented many ways to overcome the free-riding and collective action problems. Some of those solutions actually illustrate theoretical proposals offered by economists. The solutions include:

The first solution relates to the theory by Nobel Laureate economist James Buchanan. Skipping the math, it goes that between pure public goods and pure private goods, it is possible to have a third category in the middle that is exclusively enjoyed by a sizable community, aka a club. Club goods, compared to non-exclusive public goods, can more effectively deter congestion (ensuring the quality) and overcome collective action problems. Therefore, following this theory, new town management companies might want to design and offer more customized services to smaller groups of individuals, the demand of which can be more realistically gauged.

In a way, Vanke is already offering a series of club goods via its program called Vanke Club. Originally a brand loyalty program, Vanke Club offers a variety of goods to its club members, ranging from physical gifts and financial rewards to exclusive social services. Examples are its after-school programs and members-only field trip activities. These are different from traditional publicly enjoyed urban services, because the club goods are not entirely collective goods, but individualized social services reserved for members who paid the club premium. This is an innovation of Vanke’s business model, and Vanke might consider re-conceptualizing Vanke Club not only as a marketing tool, but also as a financing tool for high-quality social services and urban projects that can be financed outside of the capacity of monthly fees.

Nobel Laureate economist Elinor Ostrom states that social institutions are indispensable for long-enduring common goods institutions. The impossibility of charging public services is based on the assumption that people live in an abstract world with no social bonds. However, in real communities, social norms and cultural bonds prohibit people from acting in an entirely selfish fashion, because free-riding would not be tolerated if they want to stay in the community for a longer time. The economic problem of public goods can thus be mitigated if you consider the social dimension of repeated games. In this way, social institutions can function as monitoring systems that ensure the cooperation among individual appropriators of collective resources.

Due to cultural and historical reasons, collective lifestyles have almost been eradicated in urban China. In some Western new towns, such as The Woodlands in Texas, religion was used strategically to ensure social cooperation for large communal projects. However, in China, due to political reasons, it is impractical to emulate The Woodlands and use religion to unite people. Nevertheless, Vanke is using other strategies to create a sense of collectivism, such as the shared supply of food and communal dining spaces in the community. This shared consumption reminds people of the communist institution of “village collectives,” which begins to foster neighborhood affinity and sociability in the large residential communities. Maybe Vanke Property Management can first use this social dining program to let residents in the community know each other, and then strategically utilize their social bond and mutual monitoring to carry out large urban service projects that require intensive customer input (either money or manpower).

As Mancur Olson points out in his seminal analysis of collective action, confederation can facilitate large group’s action. By dividing the nearly-not-organizable large group into smaller ones, each person would be more effectively incentivized and monitored, thus overcoming the free-riding problem. Therefore, management companies might want to design new ways of service provision: rather than dealing with the entire community altogether, the supplier could instead subdivide the customers into different groups, according to either preference differences or spatial boundaries, and each section will then become a manageable target.

Vanke has experimented in demographic confederation. In addition to providing general services to every resident, such as managing a school, Vanke reacts to people of diverse demands with specific customized products. It confederates the overall residents into small groups according to age. For senior residents, it offers house repair services, senior colleges, and senior care centers; for working parents, it offers after-school programs to take care of the children before their parents come back from work. All of these products are financed not by monthly fees, but by a separate charge, which allows the company to increase its revenue, subsidizing the basic urban services that are operated at zero profit margin.

According to Olson’s analysis, if one individual in the group is willing to bear the full cost of the collective action, the group project could still be carried through. He will take the responsibility only if his personal share of the collective gain outweighs the full cost of collective action that he undertakes. New town developers who seek to jumpstart social services shall identify and collaborate with such individuals. In the Chinese context, retirees who were former company leaders are targeted as good candidates for such position. Their free time, solid organizational expertise, and good reputation among residents become an important asset to mobilize and unite the community. Indeed, in several Vanke communities, they are volunteer leaders who invest their manpower (knocking every door, knowing every person) to make sure a lot of the urban services, especially the social software, are functional in large communities.

The last principle of organizing large groups of people into a community capable of doing social projects is to have reward and/or punishment mechanisms, so as to incentivize people to collaborate. In order to solve the tendency of non-cooperation, the firm could design extra benefit that even the most selfish individual will certainly have an interest in, such as health benefit. The bundle-up of extra individual incentives and collective project may then facilitate the provision of civic goods in the community.

Vanke is beginning to use personal health as an extra incentive for people to join common projects. It first initiated many specific sports programs to cater to different interests across the demography (basketball for teenagers, yoga for young professionals, tai-chi for the elderly, and outdoor dancing for mid-aged women). Vanke then strategically use these small social organizations as privileged groups that can be mobilized to do volunteer works, which improve the quality of services provided in the community (cleaning, tree-planting, etc.). Currently, Vanke is only using their manpower; maybe in the future, the company can also motivate these people to contribute financially in exchange for health activities organized by Vanke.

Therefore, because the problem between customers and the firm is mainly regarding the lack of incentive, which leads to free-riding and collective action problems, the solution to such problem is about designing institutional arrangements that offer extra incentives. The extra incentives can be either economic or social, motivating people to contribute. In a way, the economic aspect of public goods provision and the social aspect of communal bonds are not mutually exclusive. On one hand, if the residents are not united socially through cultural, emotional, and ideological means, the company will find it hard to charge for collective goods. On the other hand, if the communal software is not provided due to structural obstacles of public economics, there will lack the important social infrastructures to form a well-bonded community. Therefore, successful urban services depend on the balance of firm’s social agenda and economic agenda, as well as the creative business models that can reconcile the conflict between those two.